Market intelligence for B2B

Modern Market Intelligence for your B2B Business

Dante Maestre MSc, Market Intelligence at AEM

Canada

Introduction

In a rapidly changing landscape, businesses need

an intelligence advantage to stay ahead of the

curve. While market leaders acknowledge the

importance of enhanced data and insights for

better decision-making, many are not fully

prepared to capitalize on these opportunities.

Market Intelligence (MI) refers to the process of

gathering, analyzing, and interpreting data about a

specific market to make strategic decisions. For

B2B businesses, this involves understanding the

market landscape, including competitors,

customers, and industry trends.

In the highly competitive world of B2B commerce,

understanding your market and staying ahead of

the curve is vital for success. MI can provide

businesses with the strategic advantage they need

to make informed decisions, drive growth, and

improve customer engagement. This article

explores the role of market intelligence in the B2B

landscape, its benefits, and the tools and

techniques used to gather, analyze relevant data

and some challenges.

B2B

Market research companies predominantly cater

to B2C businesses, as data for these entities is

more readily accessible and abundant.

Furthermore, B2C companies are more inclined to

invest in market intelligence reports, given the

superior quality of data and insights. Nonetheless,

obtaining accurate intelligence is crucial for B2B.

Competitor analysis and industry trends are vital

pieces of information that can either propel a

company to the forefront or leave it vulnerable to

disruption.

Another crucial aspect to consider for businesses

operating in any market is determining the market

size. However, estimating market size in B2B

markets poses several challenges. These include

defining the market, addressing low data

availability for B2B products, calculating market

size based on business rules, and reconciling

expectations with reality.

Defining the market entails determining the

geographical regions and product categories to

include or exclude. Data availability for B2B

markets is often scarce, making it difficult to

estimate market size. Additionally, calculating

market size involves segmenting the market,

accounting for prices, and estimating proportions

for different market segments, which can be

complex.

Fortunately, professionals in B2B environments

can create customized market intelligence using

various methods. The modern world offers a

wealth of open-source intelligence (OSINT)

available on the internet, including databases,

social media content, trade journals, and news

articles. Connecting these disparate pieces of

information can lead to a more profound

understanding of one’s market, though the most

reliable source of information is most often the

CRM of the company itself.

Another approach to generating tailor-made

market intelligence involves predictive modeling.

Identifying the variables impacting a specific topic

is crucial. For instance, B2B companies often serve

as a vital link in the value chain, and their products

and applications are typically more complex than

those of B2C counterparts. Accurately estimating a

specific commodity’s market size may require

analyzing end-product volumes and combining this

data with market characteristics. By employing

these methods, B2B companies can develop

comprehensive market intelligence to guide their

decision-making processes.

Another approach to generating tailor-made

market intelligence involves predictive modeling.

Identifying the variables impacting a specific topic

is crucial. For instance, B2B companies often serve

as a vital link in the value chain, and their products

and applications are typically more complex than

those of B2C counterparts. Accurately estimating a

specific commodity’s market size may require

analyzing end-product volumes and combining this

data with market characteristics. By employing

these methods, B2B companies can develop

comprehensive market intelligence to guide their

decision-making processes.

Despite these challenges, it is crucial for businesses to act on the market sizing information they gather. Accurate market size estimates can lead to data-driven insights, which, in turn, enable better decision-making. These insights might reveal underperforming sales teams, the need for strategy adjustments, or missed opportunities. Embracing such outcomes and adjusting accordingly can significantly benefit a company, as data-driven decision-making outperforms gut feelings or existing routines.

Despite these challenges, it is crucial for businesses to act on the market sizing information they gather. Accurate market size estimates can lead to data-driven insights, which, in turn, enable better decision-making. These insights might reveal underperforming sales teams, the need for strategy adjustments, or missed opportunities. Embracing such outcomes and adjusting accordingly can significantly benefit a company, as data-driven decision-making outperforms gut feelings or existing routines.

Gathering the Data

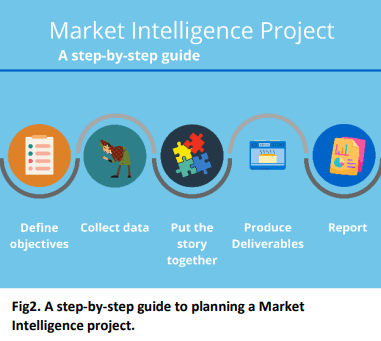

A successful (MI) project begins defining and

prioritizing intelligence requirements. Stakeholder

goals may vary within a company, from sales

representatives seeking ways to stand out points

to executives using MI for growth strategies and

identifying a competitive advantage.

Once the intelligence requirements are clear

information is collected from OSINT and human

intelligence (HUMINT). Examples of valuable OSINT

sources are job postings, Glassdoor reviews, and

published interviews with upper management. A

competitor’s hiring plans can give insight into

planned expansions and projects. HUMINT, on the

other hand, involves gathering intelligence

through interpersonal contact. Examples include

tapping experienced sales representatives or

conducting win/loss analyses with clients.

Different data sources are suitable for various

industries. For instance, in manufacturing, there is

an increasing interest in using weather data to

deliver valuable insights for supply chain

management. In the pharmaceutical sector, the

Internet of Things (IoT), particularly with

wearables, provides a wealth of market

intelligence. In the oil and gas industry, a company

may create an AI-powered knowledge platform for planning, design, and incident reporting related to

well drilling. In financial services, banks and

investment firms increasingly rely on alternative

data to shape their trading strategies.

As data sources multiply and organizations seek

intelligence from unfamiliar industries or markets,

businesses will need guidance to find high-quality

insights. Often, they will encounter unfamiliar

material from sources they cannot easily

contextualize. The final step involves analyzing the

collected data, transforming the gathered

knowledge into actionable intelligence. Figure 2

summarizes the above steps when creating a MI

report.

Intelligence Products

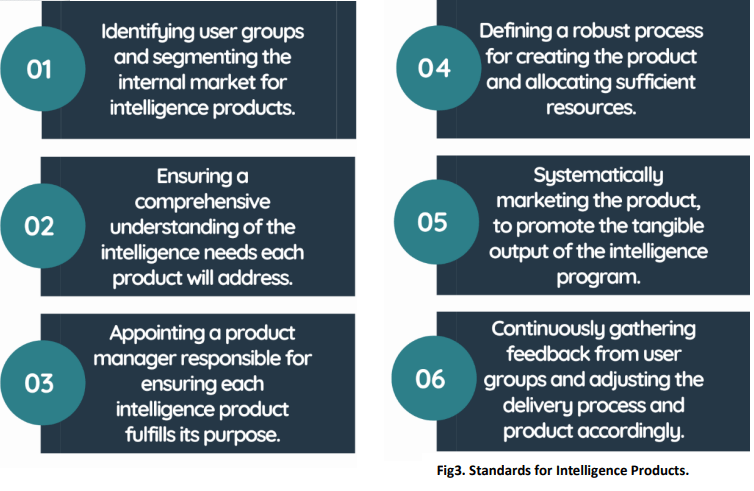

When establishing quality standards for

intelligence deliverables, it’s useful to view the

entire intelligence program as an organization that

creates marketable products for end-users, like a

company. Producing customized deliverables for

ad hoc needs is expensive, challenging to manage,

market, and measure systematically. The solution

lies in a well-planned and executed intelligence

product and process development, which

enhances the professionalism of the intelligence

program.

An intelligence product is the result of a systematic

intelligence process, with defined users, resources,

information topics, format, delivery channels, and

schedule. Product development involves

standardizing the format and production process

of intelligence deliverables. The content will

change each time, reflecting the latest insights and

foresight related to business environment

developments.

By implementing formal structures for producing

intelligence products, the intelligence team may

gain more time and flexibility. When the process of

creating regular intelligence output follows

consistent, predictable steps and schedules, team

members can better assess the time and effort

required for ad hoc assignments that are integral

to any intelligence program. These deliverables are

often delivered to the foresight manager. Big

manufacturing companies like Evonik and BASF

have skilled foresight managers that use these

deliverables to define strategic goals for the year to

come.

MI for Supply Chain & Risk Mitigation

Market intelligence plays a crucial role in

optimizing supply chain. By analyzing data on

supplier performance, industry trends, and

customer demands, companies can identify areas

of improvement and make strategic decisions to

enhance efficiency, reduce costs, and minimize

disruptions. This involves evaluating supplier

reliability, gauging the potential impact of

geopolitical and economic factors on the supply

chain, and identifying alternative sources of raw

materials or components. Furthermore, market

intelligence can help businesses proactively

address changing customer needs, enabling them

to optimize inventory levels, streamline

distribution channels, and enhance product

availability.

Geopolitical risks, such as trade disputes, currency

fluctuations, or political instability, can also have a

significant impact on business operations. MI

enables businesses to monitor these factors,

assess their potential implications, and develop

contingency plans to minimize their impact on the

supply chain, sales, and overall business

performance.

Additionally, a MI department can help companies

navigate the complexities of regulatory changes,

ensuring compliance and minimizing the risk of

penalties or reputational damage. By staying

informed about evolving regulations, businesses

can adapt their processes, invest in necessary

resources, and maintain a proactive stance

towards compliance.

As a bonus, market intelligence can facilitate

collaboration between supply chain partners,

fostering a data-driven culture that encourages

information sharing and transparency. This

collaborative approach allows businesses to

collectively respond to market changes, mitigate

risks, and seize new opportunities, ultimately

driving supply chain resilience and agility. By

leveraging market intelligence, B2B businesses can

create a more responsive and adaptive supply

chain, capable of navigating the challenges and

uncertainties of today’s global marketplace.

Sustainability and Market Intelligence

As companies increasingly recognize the

importance of sustainable practices in their

operations and decision-making processes,

sustainability intelligence has emerged as a critical

component of a comprehensive market

intelligence program. Sustainability intelligence

focuses on collecting, analyzing, and utilizing data

related to environmental, social, and governance

(ESG) factors, enabling organizations to better

understand the impact of their actions on society

and the environment while making informed

strategic decisions.

Companies like S&P Global and IBM have

recognized the growing importance of

sustainability factors in market intelligence and

decision-making processes. These companies have

realized that such factors are critical drivers of

business and investment performance. By offering

ESG ratings, sustainability indices, and data and

analytics on a range of sustainability topics,

companies like S&P Global are helping their clients

to identify sustainable investment and business

opportunities, as well as to manage risks related to

environmental and social impact.

Moreover, these companies are also incorporating

sustainability into their own operations and

strategies, setting science-based targets for

reducing greenhouse gas emissions, and joining

initiatives to promote greater transparency and

accountability around sustainability issues.

Case Study: BASF Intelligent Mine

Recognizing the growing need for innovation in the

mining industry, BASF has capitalized on this

opportunity to combine their expertise in mineral

processing and ore beneficiation chemistry with AI

technology. The result is the ‘BASF Intelligent Mine

powered by IntelliSense.io’, a platform aimed at

enhancing mine operations’ efficiency,

sustainability, and safety.

Through comprehensive market intelligence, BASF

has identified critical areas within the mining

sector that demand digitalization and

optimization. This insight led to the development

of the open, real-time decision-making platform,

designed to be easily tailored to individual sites

within three months.

The platform supports various mining processes,

such as grinding, thickening, flotation, and pumping, with Optimization as a Service (OaaS)

applications. These applications predict and

simulate future performance, generating processspecific recommendations, and creating efficiency

improvements across the entire mine-to-market

value chain.

This partnership with IntelliSense.io is a prime

example of how BASF has effectively employed

market intelligence to drive the development of

cutting-edge technology and provide valuable

solutions for its customers. In doing so, BASF has

also solidified its reputation as a company

dedicated to addressing industry challenges with

forward-thinking and sustainable solutions.

Market Intelligence at AEM

AEM has effectively used market intelligence to

identify and expand into new markets. Our

modern MI department constantly explores

opportunities to grow its customer base and

diversify its product and service offerings.

Leveraging market intelligence, AEM has been able

to identify relevant trends within sectors of

interest such as sustainable fluids, e-mobility, and

off-grid solutions. By analyzing data on customer

preferences, consumer behavior, preferences, and

purchasing power, along with local economic

conditions and regulatory environments, AEM has

gained valuable insights that have informed its

market entry strategies and localized offerings.

AEM actively utilizes MI in managing its supply

chain to reduce risk, improve product quality,

achieve environmental and social goals, and

enhance overall performance for the company,

customers, and suppliers. By employing MI, AEM

can make well-informed decisions and implement

robust programs to educate and engage

manufacturers.

Contact the author: Dmaestre@aemcanada.com