HPA transforms into the vital sapphire components integral to LED and

watch cover production by enhancing its quality and sustainability.

Environmental costs are in the focus of sapphire production, which can

be minimised by using low-emission HPA produced by Advanced Energy

Minerals/CA.

Sapphire – a material with outstanding properties.

Sapphire is a key component to our everyday life due to its transparency, scratch resistance, and high thermal conductivity.

These properties make it ideal for various uses, such as scratchproof windows,

translucent ceramics and insulating layers

for semiconductors. A sizeable quantity of sapphire is used to make jewellery and watches, where recent trends have lead to a higher demand from consumers for sustainable products.

Manufacturing HPA starts with a mineral

feedstock. If this feedstock is manufactured

with hydropower as the only energy source,

its only carbon impact occurs from the

transportation. If the mineral source is close

to the factory, this can be minimal or even

brought to zero by compensation

Such is the case for Advanced Energy Minerals (AEM) which manufactures HPA in

Québec/CA; a region blessed by ubiquitous

hydroelectric infrastructure utilising regional feedstock produced predominantly with

hydroelectric power.

The report is in accordance with the classification proposed by the Greenhouse Gas

Protocol (GHG Protocol).

This is in strong contrast to alumina producers using the traditional alkoxide processes,

who typically have very poor utilisation of

renewables, which emits 12,3 t of CO2

per

ton of HPA. Other producers have a goal

of reducing this by a factor of five, which

is still very high. AEM has also a product

line to deliver customised 4N (99,99 %)

and 5N (99,999 %) purity compacted alumina monolithics to its customers. These

ranges in size from pucks of a few grams to

giant pucks of up to 21 kg. 4N HPA is typically employed for LED applications, while

an even purer variant, 5N HPA, is used for

optics.

The processes to convert HPA to sapphire

all melt the alumina at a temperature above

2050 °C. This is followed by a slow cooling process that takes one to two weeks to

create a crystal of sapphire. Because this is

a relatively low-tech process, the crystal is

not perfect. It can, however, be influenced

by the quality of the HPA used and the dexterity of the furnace operator. Lower-purity

HPA is used for LEDs.

The next level of purity finds application

in watch covers. The highest quality HPA

is transparent to deep UV due to its low titanium content. This makes it suitable for

medical applications.

Crystallisation issues may also impact the

final product quality and determine the final application. For instance, an LED device

containing an imperfect and inhomogeneous sapphire component may experience

decreased efficiency, a shorter lifespan, or

a variation in emitted colour. In addition to

HPA quality, the different sapphire growing

processes yield crystals that are suitable

for different applications.

Sapphire “carrots” for watch covers

Sapphire crystals for watch covers are

traditionally grown with the Verneuil process. The result that awaits further processing is called a “carrot” in the trade

(Fig. 1). It is close to a cylinder in form,

approximately 15 cm high and 3–4 cm in

diameter. Of course, this step has a typical energy requirement if not performed

with green energy. The relevant CO2

emission would be an average of 89 g/kWh for

Switzerland, where environmental issues

have a strong focus, or 475 g/kWh worldwide.

Because the crystal sapphire carrot has an

imperfect form and contains defects, there

will be substantial yield loss during the

further processing steps. This loss can be

minimised by generating a digital model of

the carrot that is based on a 3D scan with

specialised confocal tomography equipment.

It is worth noting that cutting and polishing

sapphire is highly energy-consuming, as

the material’s exceptional hardness presents a significant challenge. The first step

with yield loss is the scrapping of carrots after inspection and before further processing due to an unacceptable rate of defects.

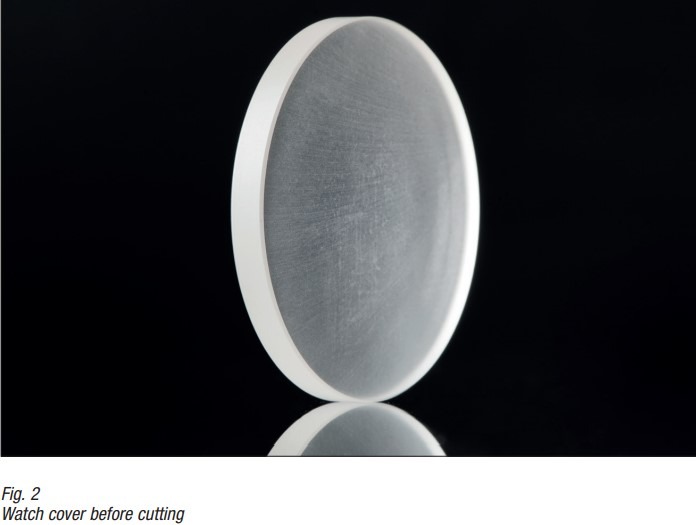

The yield from slicing the core into wafers

and polishing them is 85 %. The result is

an average combined yield of 28 % in

the watch industry for a flat watch cover

(Fig. 2). This will have a diameter ranging

from 25–45 mm and a thickness from 1,6–

6 mm. The typical weight is 4,6 g.

These steps can all be optimised with

digital quality control from the Swiss company Scientific Visual. The company manufactures scanners for quality inspection of

industrial crystals. Using these automated

tools, individual steps can be optimised

to avoid defects. For example, it prevents

defective crystal parts from entering costly

processing. In addition, by providing feedback to crystal growers, fewer crystals will

have to be scrapped. The simulated form

for the cylinder can be moved so that a

minimum of defects remain in the physical

carrot. Slicing can also be offset to bring

defects between adjacent wafers. These

steps all work to bring the yield for a flat

cover to 34 %. For a domed watch cover,

the improvement is from 4 % to 5 %, which

is a 25 % improvement

Effect of low-emission HPA from AEM for

watch cover production is considerable. In

the worst-case scenario, HPA emits 12,3 g

of CO2

per g of HPA. Manufacturing the flat

watch cover emits: 12,3 g× 4,6 g/0,28

yield = 202 g and the domed watch cover

emits: 12,3 g × 4,6 g/0,04 yield = 1400 g.

The use of current low-emission HPA and digital quality control reduces these values

to 20 g and 138 g, respectively. This is even

before zero-emission HPA eliminates the

cost completely, if not the wastage.

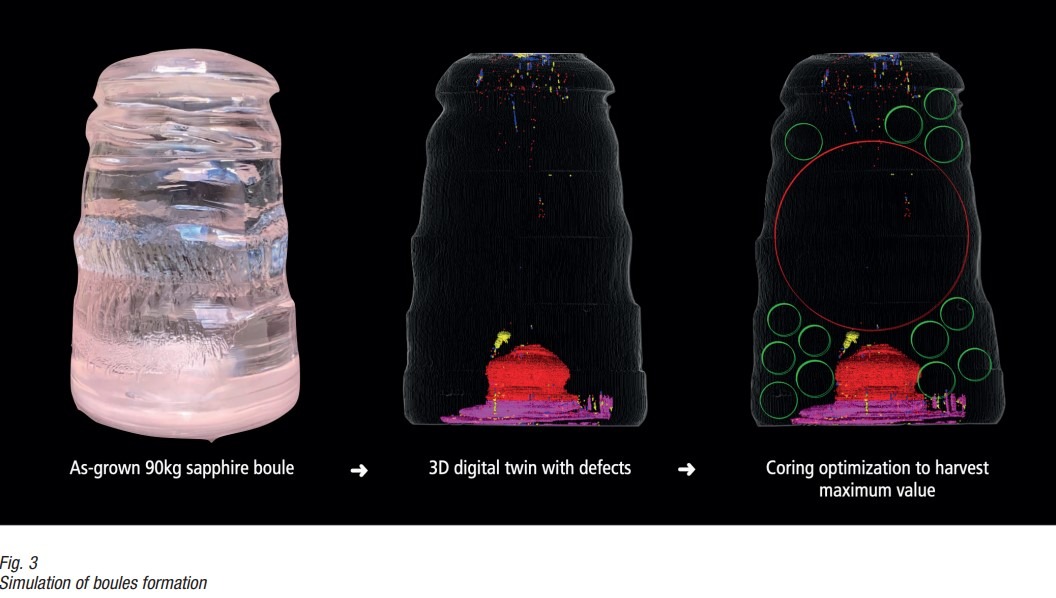

Sapphire “boules” for LEDs

The production of synthetic sapphire crystals, known as “boules”, from HPA powder

or monoliths is a complex process where

size matters (Fig. 3). Sapphire boules serve

as the starting material for thin wafers

(250–150 μm) that later become LED substrates during production.

The diameter of the finished LED wafers is

determined by the size of the boules. This diameter can range from 2″ (almost obsolete

now) to 6–8″ (common today) to 12″ (future

standard). Competition requires growing

larger boules, which is more economically

viable. For context, a 90 kg boule that accommodates an 8″ core diameter, has a bottom diameter of 30 cm and stands at 45 cm

tall. The largest sapphire boule produced at

the time of writing is 800 kg and measures

70–80 cm tall. It was manufactured in

China.

Growing such boules demands precision,

expertise, and time. The LED sapphire is often produced using the Kyropoulos growth

method, which allows the largest crystals of

the highest quality to be produced. The process begins with a slightly imperfect sapphire seed coming into contact with high purity alumina melt at around 2050 °C. As

the crystal grows, it is surrounded by the

melt and continues to grow until its surface

reaches the crucible walls and gets lifted to

restart the growth cycle.

Growing such boules demands precision,

expertise, and time. The LED sapphire is often produced using the Kyropoulos growth

method, which allows the largest crystals of

the highest quality to be produced. The process begins with a slightly imperfect sapphire seed coming into contact with high purity alumina melt at around 2050 °C. As

the crystal grows, it is surrounded by the

melt and continues to grow until its surface

reaches the crucible walls and gets lifted to

restart the growth cycle.

This method allows crystallisation at low

temperature gradients, resulting in lower

thermal stresses in the crystal. For a 90 kg

boule, the process takes 17 days – 8,5 days

to grow the crystal and another 8,5 days to

cool it down, and for 800 kg it is far more

than a month.

Sustainability is also a key component of

this process, as the crystal-growing furnace can consume 200 kW of electricity

or even more. Sapphire manufacturer Alox

Technology, based in Washouga/US, uses

hydroelectric power from the nearby Columbia River for crystal growth.

This highlights how the LED industry not

only produces products with low power

consumption but also promotes environmental sustainability.

In order for the boule to become a LED

substrate, it must first be processed into a

core, or “cored”. But before that, it must be

ensured that the parts of the boule volume

that are used for wafer production are free

of defects such as small bubbles, cracks,

and impurities. This is where the company

Scientific Visual from Switzerland come in,

offering advanced crystal inspection equipment.

After coring, the extracted cylinders are

“wafered” into thin slices that are about

300–800 µm thick, depending on the diameter. Sapphire has a hardness just below

that of diamond, so diamond saws and

considerable energy is used for cutting

and wafering. The wafers are then further

refined through processes such as grinding

and polishing to prepare them for the next

phase of their life in an LED.

After the rigorous process of inspecting and

cutting, the sapphire boule is transformed

into thin wafers that serve as the LED epitaxy. Each wafer is placed in a chamber

heated to 900 °C to grow the light-emitting

layers on it, taking advantage of the sapphire’s high-temperature stability.

With that miniaturisation, the industry is

facing stricter standards for the final products. This ripple effect on the end products

gets to the first production steps, such as

high purity alumina production. A close

relative of the LED, the miniLED, is characterised by its smaller size. A miniLED

measures between 100–200 µm on a side,

which, while smaller than a typical LED, still

packs a powerful punch in terms of brightness and efficiency.

The future of display technology is often

associated with microLEDs. Although they

currently find a home primarily in high-end

displays due to their high production costs,

their potential is immense.

The future of display technology is often

associated with microLEDs. Although they

currently find a home primarily in high-end

displays due to their high production costs,

their potential is immense.

Market forecast for sapphire and HPA –

Green Alliance for Sapphire

The LED industry is a dynamic and rapidly evolving field,

with new technologies and applications emerging regularly.

As the demand for more efficient, brighter, and smaller light

sources continues to grow, the role of HPA and sapphire in

the LED industry will only become more critical.

In 2022, the projected total volume of high purity alumina

was approx 35 000 t, with a substantial 30 000 t designated

for LED production. Looking ahead to 2025, the demand for

HPA is expected to rise to 58 000 t, with LEDs accounting for

a significant 49 000 t, or an impressive 84 % of the total. By

2028, the demand for LEDs is forecasted to reach a remarkable 85 000 t.

In essence, LEDs have been and will continue to be, a crucial

market for HPA, even as new applications emerge and other

markets expand.

As for sapphire, the global market for these crystals attained a value of USD 903,3 million in 2021, according to

the IMARC Group. They anticipate this figure to escalate to

USD 2471,4 million by 2027, with a CAGR of 18,5 % during

the period from 2022 to 2027.

With this growth potential it is relevant to watch the carbon

foot print of the processes involved.

A project called Green Alliance for Sapphire, is a kind of consortium of companies active along the sapphire glass value

chain that acknowledge that sapphire is not a sustainable

product and its production causes significative carbon emissions. Moreover, the partners in the alliance are committed

to working to bring to the market a more sustainable sapphire, and by doing so, contributing to the decarbonization

of the industry. For AEM it is important to be in this network.

[1] OPTEL Carbon footprint assessment report for Advanced Energy (upon request)